Table of Content:

- Comparative Market Analysis (CMA) For House Price Estimation In Mumbai

- The Human Element in CMA Property Valuation Model

- Benefits of CMA

- Automated Valuation Models (AVMs) For Property Valuation In Mumbai

- The Speed and Efficiency of AVMs

- The Role of Data in AVMs

- The Advancement of Machine Learning in AVMs

- Introducing Clicworth - Your Trusted Property Valuation Tool

- The Personalized Touch of Clicworth

- The Power of Choice For Accurate & Instant Online Property Valuations

Hey there, Mumbai home seekers! If you're in the market for a new property, you've probably heard the terms "comparative market analysis" and "automated valuation models." These two methods are widely used to determine property market value in Mumbai, but what exactly do they entail, and how do they differ?

As Indian real estate experts, we’re here to shed some light on this topic and help you understand the ins and outs of property valuation methods. So, let's dive in!

Comparative Market Analysis (CMA) For House Price Estimation In Mumbai

As the name suggests, Comparative Market Analysis(CMA) involves comparing the property you're interested in with similar properties that have recently been sold in the same area. By examining the sale prices of comparable properties, taking into account factors such as size, location, amenities, and condition, an estimate of the property's value is derived.

Since Mumbai's real estate market is dynamic, with prices varying across different locations, property types, and amenities, a CMA helps sellers determine the right house price estimation in Mumbai based on comparable properties, ensuring a fair and competitive market value. For buyers, it helps in negotiating a reasonable purchase price, preventing overpaying for a property.

1. The Human Element in CMA Property Valuation Model

One of the key aspects of CMA is the involvement of real estate professionals who possess local market knowledge and expertise. These professionals analyze the data, make adjustments based on the property's unique characteristics, and provide a comprehensive report on property’s valuation in Mumbai. The human element in CMA allows for subjective judgment and fine-tuning of the valuation process.

Check: Updated Property Prices Online In Mumbai

2. Benefits of CMA

CMA offers several advantages. Firstly, it takes into account the nuances of Mumbai's local real estate market, capturing the intricacies that automated models may overlook. Secondly, the involvement of real estate professionals allows for personalized insights and advice based on their experience. Finally, CMA can provide a more accurate property valuation in Mumbai - especially in areas where property data is limited or unreliable.

In a bustling city like Mumbai, where the real estate market is highly competitive and ever-evolving, Comparative Market Analysis holds immense importance. It allows buyers, sellers, and investors to make informed decisions based on accurate data and market trends. By leveraging the power of CMA, stakeholders can ensure property’s market value in Mumbai, gain a competitive edge, identify investment opportunities, and mitigate risks.

Explore: These Cheapest Areas To Live In Mumbai

Automated Valuation Models (AVMs) For Property Valuation In Mumbai

In recent years, technology has introduced automated valuation models into the real estate industry. AVMs rely on algorithms and data analysis to estimate property values. These models consider various data points, including recent sales, property characteristics, market trends, and even demographic information to generate valuations.

With its ever-growing population and limited land availability, property prices in Mumbai are constantly on the rise. In such a dynamic market, accurate property valuation in Mumbai becomes crucial for both buyers and sellers. This is where automated property valuation models (AVMs) have emerged as game-changers, providing reliable and efficient solutions.

Explore: Mumbai’s Locality Trends: Latest

1. The Speed and Efficiency of AVMs

One significant advantage of AVMs is their speed and efficiency. With just a few clicks, you can obtain instant property’s market value in Mumbai using an online AVM tool. This quick turnaround time is especially useful when you need a rough estimate or want to explore multiple properties. AVMs provide a convenient option for initial research and screening potential properties.

2. The Role of Data in AVMs

AVMs rely heavily on data, including public records, property listings, and historical sales data. While data-driven models can provide valuable property’s estimated value online and other price insights, it's crucial to note that their accuracy is contingent upon the quality and reliability of the data available. AVMs may face challenges in capturing unique property characteristics or accounting for recent changes in house price estimation of Mumbai’s local market.

3. The Advancement of Machine Learning in AVMs

With the advancement of machine learning algorithms, AVMs have become more sophisticated over time. These models continuously learn from new data, improving their accuracy and predictive capabilities. However, it's important to remember that AVMs are not foolproof and may not capture the full context and intricacies of a property's value.

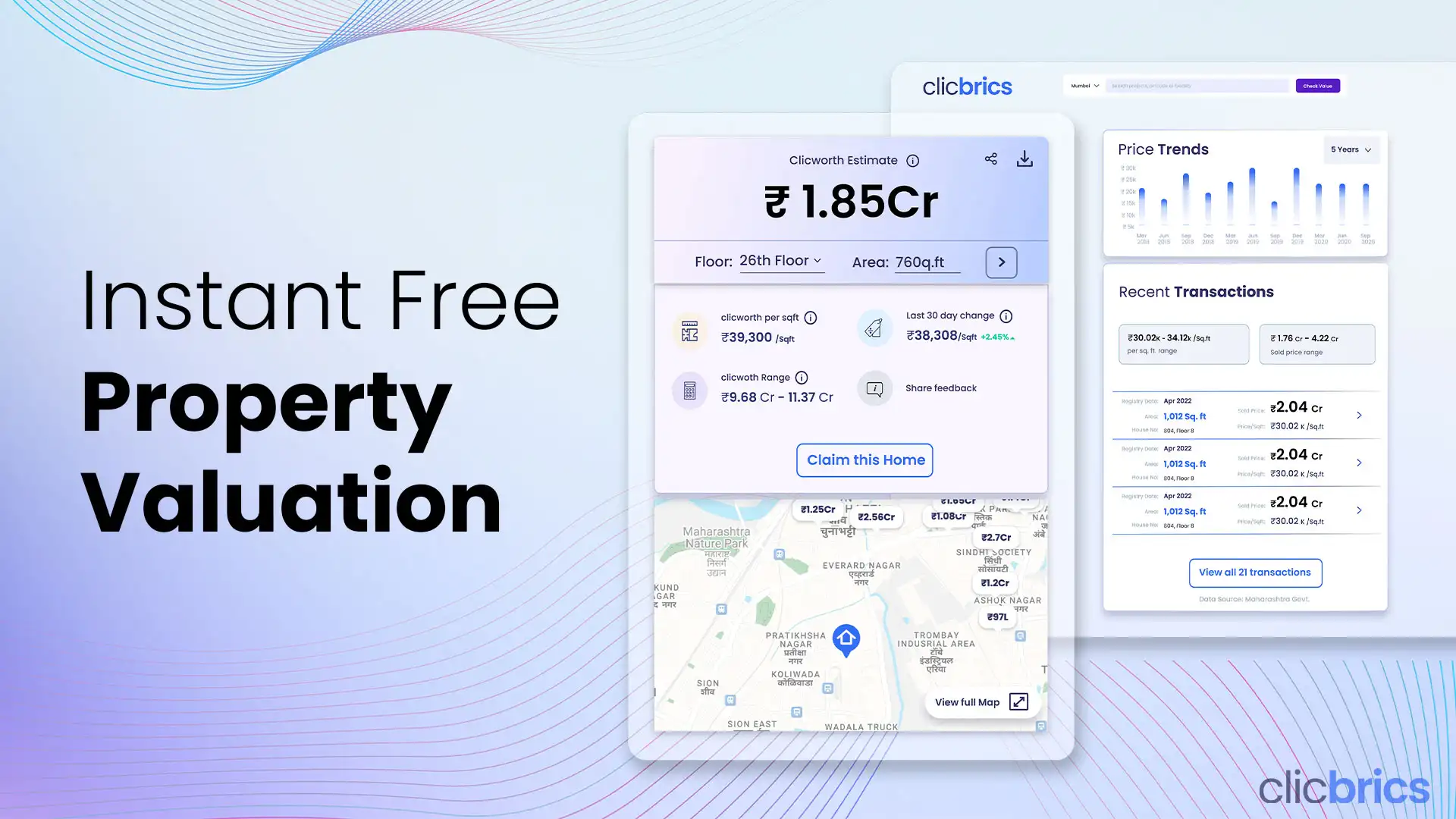

Introducing Clicworth - Your Trusted Property Valuation Tool

This article won’t be complete without the mention of Clicworth—an innovative property valuation tool designed specifically for Mumbai's real estate market. Clicworth combines the best of both worlds, leveraging both human expertise and advanced algorithms for accurate property valuation in Mumbai.

By inputting key details such as the property's address and size, Clicworth generates an instant valuation report that takes into account recent sales data, market trends, and local insights.

The Personalized Touch of Clicworth

Clicworth goes beyond automated calculations by incorporating the knowledge and expertise of local real estate professionals. These professionals validate Mumbai’s market data, make adjustments for unique property characteristics, and provide personalized insights to ensure more accurate property’s market value in Mumbai.

With Clicworth, you can benefit from the speed of AVMs without sacrificing the personalized touch of human expertise.

Explore: Online Property Valuation In Mumbai

The Power of Choice For Accurate & Instant Online Property Valuations

When it comes to property valuation methods, both comparative market analysis and automated valuation models have their merits. By understanding the strengths and limitations of each approach, you can make an informed choice based on your specific needs. Whether you prefer the in-depth analysis of CMA or the speed and convenience of AVMs, the ultimate goal is to gain a better understanding of a property's value.

Conclusion

Property valuation in Mumbai involves a delicate balance between objective data analysis and subjective judgment. Comparative market analysis provides a human touch, leveraging the expertise of real estate professionals, while automated valuation models offer speed and efficiency. With tools like Clicworth, you can harness the power of both approaches, benefiting from accurate valuations and personalized insights. Remember, property valuation methods are mere tools to aid your decision-making process, but ultimately, your own research, due diligence, and consultation with real estate professionals will ensure a successful real estate journey in vibrant Mumbai.